2015~2021 全球不鏽鋼市場需求分析

2022 Jan 21 產業訊息

STS Flat: Q3/21 Production / Trade / Consumption Complete

Market News, GlobalQ3 production, trade and consumption data for stainless steel flat products (CRC, HRC, PMP) are finalized and available in the stainless steel club now. Strong yoy AC growth in Europe.

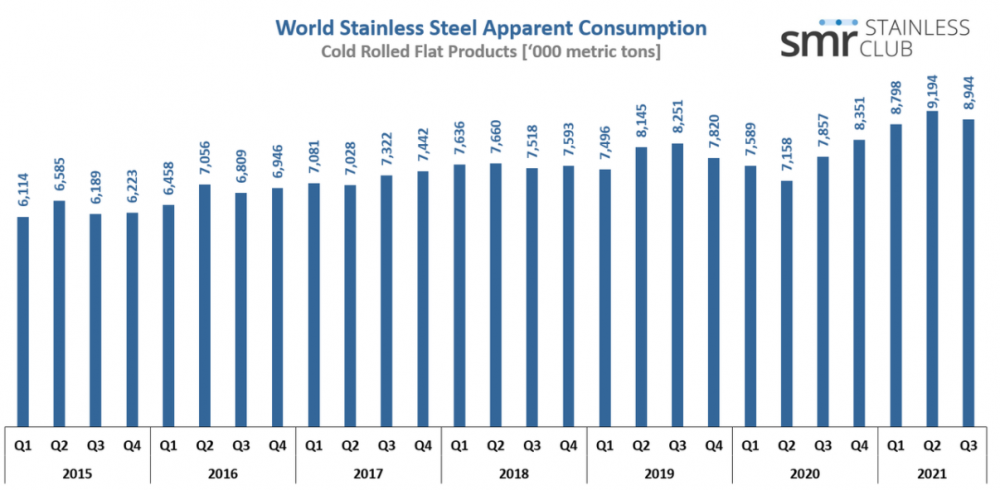

Production: Stainless steel cold rolled reached 8.94 million t in Q3 after 9.19 million in the second quarter. The lower number was driven by the seasonal development in Europe (Q3 usually below the second quarter production level due to summer holiday period) and China (production decline in Q3 and Q4 after extremely strong level in Q2/21). Plate mill plate production was stable at 397 kt after the same level in the previous quarter. Main producing country was China 165 kt, followed by Japan (38 kt).

Trade: Im- and exports for all countries are available until September 2021, for some (mainly Asian countries) October trade data are already included.

Cold Rolled Sheet: September exports grew to 759 kt, which has been the highest monthly level in 2021 (August: 628 kt, September 2020: 559 kt). Main exporters were China (141 kt), Indonesia (104 kt) and Taiwan (66 kt).

In the third quarter total exports and imports reached 2.11 million t. Exports: biggest suppliers from producing countries were China 448 kt, Taiwan 217 kt, Indonesia 188 kt, Finland 169 kt and Belgium 127 kt. Imports Q3/21: Germany 252 kt, Italy 195 kt, Netherlands 161 kt, China 136 t and India 96 kt.

PMP: Im- and exports in September accounted for 51 kt (2nd highest level after March 2021) after 41 kt in August. In Q2/21, trade stood at 139 kt world-wide in Q3/21. Main exporters were Belgium, Slovenia and Sweden. Importers: Different to cold rolled flat products, the PMP business is mainly a local business – biggest importers world-wide are Germany and Italy with both only have a negligible production of stainless steel plates.

Apparent Consumption: Yoy European growth (in tonnage) bigger than China. Q3 Demand remained at a high level but could not fully reach the Q2/21 levels again in most countries and regions. Nevertheless, global demand was 1.1 million t higher than in the same quarter of 2020. In tonnage, the additional volume yoy was even higher in Europe than in China (291 kt versus 252 kt).

In Q3/21, STS Cold rolled AC stood at 8.94 million t – biggest consuming countries were China with 4.94 million t (55% of global demand), followed by India (837 kt), USA (444 kt), Germany (293 kt) and Italy (288 kt). PMP: Total demand stood at 397 kt, main consuming countries were China (159 kt), South Korea (35 kt) and United States (34 kt).

0則留言